Financing your Summer

As the school year draws to a close and finals draw near, the average college student begins contemplating options for summer. Whether a summer job is around the corner, or rather a summer vacation of travel and fun in the sun, there is a tendency to let financial well-being fade into the background in a list of priorities. You don’t want to end your summer regretting the choices you’ve made. So be wary! For those who are not careful and take responsibility for their finances, summer can sap finanaces and leave you broke. With this in mind, here are some helpful tips designed to keep you on track for financial well-being during your summer.

First and foremost, when the semester ends, keep deadlines in mind in planning out your summer and thinking forward to your next semester or career path. I know what you may be thinking: Heck yes! Freedom! Deadlines? It is easy to sweep deadlines aside and instead opt for shopping, amusements and beach days. However, pushing things to the side, one can not escape the realities of loan repayment, university deadlines and financial aid documentation.

Secondly: think summer! Think savings! Start saving for your next semester. Form a budget where you start to put aside savings and map out your spending. Another area of savings is found in taking summer courses. Now, more than ever before, there are options for summer classes, which can amount to thousands of dollars in savings in the long run and enable students to graduate early (Driscoll, 2012).

After forming a personal budget plan, establish a form of income to offset your costs. By doing so, you will earn money to finance summer spending, while boosting your earning potential through relevant internships, volunteer or work experiences related to your career interests (SALT, 2014). Keep in mind that even if you can’t manage to find a work experience with clear links to your area of study, a part-time/full time job experience shows future employers that you responsible with your finances and provides other valuable life skills to your resume.

While building life skills through work experience, establish your professional profile. Now more than ever before, it is easy to organize a professional profile with websites like Linkedin. With such sites, you can set up a profile; organize your skills and experiences in a resume; and further prepare yourself for work beyond your college career. According to LinkedIn reviewer Jill Duffy (2013), “LinkedIn remains a great site that delivers real results for both networking gurus as well as people who are sometimes wallflowers in real life.” It is thus in creating a professional profile that such websites enable you to network within your career field and make connections with potential employers.

Although work and professional profiles are an essential part of your future career, it is still important to take at least a week off to enjoy your summer. Travel to new places, take a vacation and, most importantly, have fun. It is just as important to relax and restore during the summer (Burnsed, 2011). However, keep a budget in mind and plan your expenses so as to make the most of your experience without breaking the bank!

In closing, make the most of your summer as a college student by budgeting your time and money. Remain financially responsable by keeping track of deadlines and expenditures, as well as developing career skills and a professional profile. Take a break and experience new things. Your summer is what you make it, so make it count and get PAID.

Sources:

Burnsed, Brian. (June 29, 2011). 5 Tips to Use the Summer Before College Wisely. Retrieved April 30, 2014, from http://www.usnews.com/education/best-colleges/articles/2011/06/29/5-tips-to-use-the-summer-before-college-wisely

Driscoll, Emily. (June 22, 2012). Five Things Every College Student Should Do This Summer. Retrieved May 5, 2014, from http://www.foxbusiness.com/personal-finance/2012/06/22/five-things-every-college-student-should-do-this-summer/

Duffy, Jill. (November 27, 2013). Review: LinkedIn. Retrieved April 29, 2014, from http://www.pcmag.com/article2/0,2817,2143275,00.asp

SALT. (2014). Why Having An Internship Matters. Retrieved April 27, 2014, from https://www.saltmoney.org/content/media/Article/why-having-an-internship-matters/_/R-101-4665

Is a Master’s degree right for you?

One question many students ask themselves throughout their under-graduate career is whether a Master’s degree is a career step they see themselves taking in the future. However, many still question the related costs and benefits of a Master’s. It is only by weighing these factors that one can decide whether such a degree, with a significant cost, will enable them to become more competitive and qualified candidates in a job search. It’s a matter of living within your means with a comprehension and capacity to finance debt, while expanding your horizons and investing in the future.

The first step in considering any grad school is shopping for available options. Before engaging in such an endeavor, one must be aware that Master’s Programs are available for both specific career paths or a general field of study. According to Peterson’s.com, a website which specializes on all things graduate school related, one might also consider a liberal Master’s degree in the arts and sciences:

“to fulfill a variety of goals, including just simply gaining deeper knowledge in a particular field. Some doctoral students pursue master’s degrees to gain additional exposure to a field related to their doctoral pursuits, and some students pursue a master’s degree to satisfy intellectual curiosity or for personal fulfillment.”1

In this manner, Master’s program tailor to the needs of a wide variety of students, ranging from teaching majors to business economics wizzes.

A secondary step is to map out costs visually and to consider the rate of return one can expect from a Master’s degree. A rate of return is the money one can expect after making an investment in education. In terms of long-term monetary advantages, obtaining a Master’s degree can boost one’s potential income in the future and increase one’s chances for promotions in the work force.

In considering the rate of return on the investment of a Master’s degree, it is further important to understand all of the costs associated with a Master’s “including tuition, student loan interest, lost wages and retirement contributions.”2 According to FinAid.org, the average cost of master’s degree for students is between $30,000 and $120,000 and the cost varies depending on the university and the master’s program itself.3 With websites such as Learnvest.com, Peterson’s.com, SALT money.org, and countless others, students now have the resources to facilitate a cost-benefit analysis and thus can plug in the numbers for their situation to calculate the rate of return for a Master’s degree.

Mapping out costs, causes one to be more aware of general costs, but in this process, one ought also consider financial aid opportunity. As far as financial aid options, it is important to apply to scholarships and to consider other options of financing college education being loans and grants. Just as the cost of a post-graduate program varies financial aid options vary. Salt money recommends that students not take out more than what they’ll be earning their first year out of college, That way, you’ll only have to put 10% of your annual salary toward your loans to pay them off in 10 years.4

If financing a Master’s program does not seem feasible, there is also the option of a Master’s abroad. Study abroad not only saves students significant amounts of money, but immerses students in a variety of different cultures, languages and geographical locations.5 Thus, the student is given a unique competitive edge with a greater sense of international cultural awareness and expansion of horizons. This type of experience on a resume indicates personal drive and mobility in competitive Master’s programs where students typically pay less in student fees and often emerge debt free. 6

Emerging debt free or capable of debt repayment should be at the forefront in one’s consideration of financing any Master’s program. To reap the full benefits of a Master’s degree, it doesn’t make financial sense to take on significant financial debt if the benefit won’t balance the cost. In this manner, a Master’s degree is also most useful to those wishing to pursue a less-traveled career path and helps graduates to stand out from the sea of potential candidates. Although this benefit sounds ideal to most, the costs and benefits are far from the adage ‘one-size-fits-all’. Thus, by weighing cost, future salary and aid options of a Master’s degree, a post-graduate can use it as stepping stone to greater career options and income potential in the future.

Sources

1. Peterson’s. (January 17, 2014). Seeking a Master’s Degree in the US. Retrieved from Peterson’s.com April 18, 2014 http://www.petersons.com/graduate-schools/seeking-masters-degree-us.aspx

2. Sheehy, Kelsey. (March 12, 2014). Calculating the Return on a Master’s Degree. Retrieved from usnews.com on April 20, 2014 http://www.usnews.com/education/best-graduate-schools/articles/2013/03/12/calculate-the-return-on-a-masters-degree

3. FinAid Page, LLC. (2014). Student Loans. Retrieved April 15, 2014, from finaid.org http://www.finaid.org/loans/

4. SALT. (2014). Grad School Salary Estimator. Retrieved April 24, 2014, from https://www.saltmoney.org/content/media/Tool/grad-degree-potential-salary-estimator/_/R-101-12042

5. Mather-L’Huillier, Dr. Nathalie. (2014). Retrieved on April 20, 2014, from findamasters.com http://www.findamasters.com/study-abroad/guide-to-masters-abroad.aspx

6. Christianson, Anne Kunkel. (May 9, 2013). US tuition too high in comparison to Europe retrieved on April 19, 2014, from https://umdstatesman.wp.d.umn.edu/2013/05/09/us-tuition-too-high-in-comparison-to-europe/

photo from: http://roomfordebate.blogs.nytimes.com/2009/06/30/what-is-a-masters-degree-worth/?_php=true&_type=blogs&_r=0

An Investment for the Future

While many will emphasize the high cost of a college education as a rationale against college education, the act of obtaining a college degree in many ways ought to be viewed in terms of long-term investment rather than short-term costs. Rather than viewing college as a lump sum to be paid off in piles of debt and other various costs, one ought consider various long term advantages of a successful college education (a successful college education in this case signifies the act of obtaining of a degree) which include, the monetary advantage of obtaining a college degree, proof of competence in the work force, as well as opportunities for personal advancement. Upon consideration of these various factors, it becomes evident that respective higher salary, better work prospects, and exploration and cultivation of interests are the most significant benefits of a college education, which justify the costs of college in the long-term and motivate students, governments and non-governmental associations to invest and promote the financial welfare of college students.

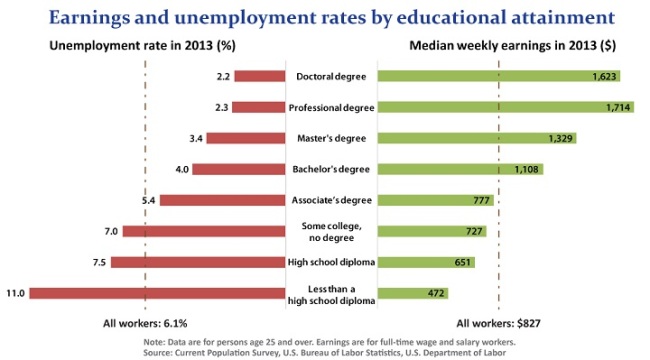

To delve into this issue, one must first consider the first component of this investment: that of long-term pay-off. College graduates face the possibility of higher salary than non-college degree counterparts and are comparatively less likely to be unemployed. As seen in the figure below, the median weekly earnings of an employee with a Bachelor’s degree are nearly that of an employee with a high school diploma. The latter employee is two times as likely as the former to be unemployed in the current job market.1

Source: http://www.bls.gov/emp/ep_chart_001.htm

In this manner, there is a significant gap in employment between those with a high school diploma and those with a Bachelor degree. This gap in employment is even more significant in the long term, where it amounts to thousands of dollars of difference in wages.

For firms and hiring bodies, a college education with a degree can serve as a measure of employee competence. In measuring employee productivity and performance, employers often times evaluate skill set, the benefits of former training and individual capability to evaluate whether or not an applicant would prove to be a valuable asset to a firm or business. It is thus that by procuring a college degree the individual is deemed worthy of an occupation through educational and vocational experience. When this vocational competence is coupled with the individual’s attitude, ability and accessibility, it is evident that an application of skills and knowledge is equally as important as the skills themselves. Ergo, a college education becomes a true measure of competence through which the employee uses standard procedures and prior training to accomplish a task.2 In this manner, the college degree serves as an indicator of skills, training and other enable business owners to invest in the employees who are proficient in the field of interest and will help build business success.

Finally, college gives individuals the opportunity to cultivate personal interests and to grow intellectually in the process. This component of a college education is often defined as, “the ability to understand and manage self, to function effectively in social and professional environments and to make reasoned judgments based on an understanding of the diversity of the world community.”3

Higher education, in this way, is about more than obtaining a degree for a foothold in the workplace. Ultimately, higher education is about making student capable of improving quality of life for themselves, their families and their communities. Students are challenged to achieve and set personal goals, to build strong character, and to effectively communicate their ideas, so as to implement positive change in society. These aspects of personal growth, often stresses as core underlying values of under-graduate institutions, supplement the economic motivation and advantages gained by students.

It is thus that a college education and the act of obtaining a graduate or under-graduate degree is a positive act through which one invests in a future of life-long opportunity. These opportunities range from economic opportunity, in the form of higher wages and employment, to personal and community growth. Thus, it appears that there is much to be gained from a college education: namely innovation and positive change in society, which improves quality of life for all involved.

Sources:

1. US Department of Labor. (March 24, 2014). Bureau of Labor Statistics: Employment Projections. Retrieved on April 10, 2014, from http://www.bls.gov/emp/ep_chart_001.htm

2. Tamkin, Penny. (2005). Measuring the Contribution of Skills to Business Performance: A Summary for Employers. Retrieved on April 5, 2014, from http://www.cipd.co.uk/NR/rdonlyres/045262BD-5812-4221-A392-214D7EC52B6E/0/mesdconsklbpsum.pdf

3. Central Piedmont Community College. (2014). Personal Growth and Responsibility. Retrieved April 2, 2014, from http://www.cpcc.edu/learningcollege/core-competencies/personal-growth-responsibility

Scholarships and Student Success

Scholarship: “an amount of money that is given by a school, an organization, etc., to a student to help pay for the student’s education” (Merriam Webster Online Dictionary, 2014). For students looking to fund their post-secondary education, this declarative statement is sometimes all that is understood in hearing the word scholarship. However, it is important to note that a scholarship is composed of more than a mere definition. In many ways, the implications of the processes encompassing scholarships as well as their true benefit are the most crucial components of scholarships, which resonate in the financial sphere and far beyond. This article will focus on these components of scholarships in an attempt to raise awareness, not only in outlining the scholarship processes and types, but by also illustrating the benefits associated with scholarships.

Determination of eligibility and need: The determination of need for scholarships involves the culmination of various factors. First and foremost, the student applying for the scholarship must demonstrate financial need. This is often a basis for selection as a scholarship is gift aid to students and giving a scholarship to an individual without need would defeat the purpose and detract from addressing the needs of other students.

A second determinant is—in most cases—merit. This nonmonetary domain of need awards gives preference to students of high academic standing who have demonstrated an impressive level of gumption. These students are seen as having gone above and beyond in terms of student achievement and thus, are more likely to stand out in the scholarship application process.

Finally, it is crucial to note that certain scholarships are type-casted towards various fields of research, academic interests or qualities such a service experience, leadership, and citizenship. Most scholarships committees take all of these factors into account when deciding upon a scholarship recipient within a group of applicants (College Board, 2014).

In commencing the scholarship process, a student ought consider these various factors which impact eligibility. A proactive step is to read guidelines for the scholarship, which often include determinants of eligibility. This should be done before applying to a scholarship, so as to eliminate unsuitable scholarships from a list of available options.

Applying: the essential components: The determinants of eligibility are determined by official sources of data. Financial need within the US is determined by the FAFSA Free Application for Federal Student Aid (USDE, 2014). Thus, for any college student or graduating high school student looking to apply for scholarship, the filing of the FAFSA is a priority in the scholarship process. The FAFSA is an essential component of the scholarship process, which is often integrated into the selection process and serves as a determinant of student eligibility. Without the data generated by the FAFSA which serves as official proof of financial aid—and safeguards scholarships from being used a ‘free money’ and rather used as ‘gift aid—in many cases, students would find themselves unable to legitimately demonstrate financial need and ergo unable to complete a scholarship application.

The second factor of merit is often dependant upon traditional measures of academic ability, such as standardized test scores, and high school grade point average (GPA). Merit is used as a predictor of college performance.Companies make an investment in students through the granting of scholarships and want to make sure that this investment is stable and well chosen. Merit, as a factor of student success, enables scholarship committees to make an educated selection among a group of plausible candidates through the selection of a hard-working student who illustrate a capacity of student success (Ganem & Manasse, 2011).

Finally, scholarships can be type-casted towards various fields of research, academic interests, or qualities—often community service experience, leadership and citizenship. In such cases, scholarships may require evidence of the applicant’s affiliation with various organizations, interests or activities. In this context, sources of proofs include a resume, work records, recommendations, and/or an essay. Some organizations require scholars to participate in an interview process to gauge interest and student involvement in various activities.

A gateway to success: Once a student has applied for scholarships he/she is on their way to financial peace of mind and even success beyond the classroom! The benefits of scholarships are said to far outweigh the costs. The first positive impact of scholarships exists in the financial realm, whereby scholarships provide a reduction of loan debt many students will face after college. By applying to a scholarship, students are given gift aid, which does not have to be paid back.

Further, as many scholarships are merit-based, they serve as a motivator of academic success. According to studies on student success and sources of student aid, scholarships “could have a direct effect on academic motivation if a student feels success is necessary to maintain a scholarship in the short term or allow the repayment of loans in the longer term” (Ganem & Manasse, 2011; Robbins et al., 2004).

Other than rewarding students for academic success and community involvement, scholarships also build professional development and individual prestige. The pay-off of scholarships extends beyond the financial realm into greater opportunities for professional development and networking (Covington, 2000). It is said that “the use of those funds which are rightfully set aside in the United States for the furthering of the training and development of persons able to take their places as citizens of worth and achievement” (Smith, 1936). In this manner, by working with scholarship committees, students are put in contact with important figures in their field of study. It is thus that scholarships boost the prospects of promising scholars and enables them to discover a world of professional opportunity beyond the confines of the classroom.

References:

-College board. (2014). The Basics on Grants and Scholarships. Retrieved March 20, 2014, from https://bigfuture.collegeboard.org/pay-for-college/grants-and-scholarships/the-basics-on-grants-and-scholarships

-Covington, M. V. (2000). Goal theory, motivation, and school achievement: an integrative review. Annual Review of Psychology, 51, 171–200.

-Ganem, Natasha M. & Manasse, Michelle. (2011). The Relationship between Scholarships and Student Success: An Art and Design Case Study. Education Research International, 2011. Retrieved March 19, 2014, from http://www.hindawi.com/journals/edri/2011/743120/

-Merriam Webster Online Dictionary. (2014). Scholarship. Retrieved March 20, 2014, from http://www.merriam-webster.com/dictionary/scholarship

-Robbins, S. B., Lauver, K., Le, H., Davis, D., Langley, R. & Carlstrom, A. (2004). Do psychosocial and study skill factors predict college outcomes? A meta-analysis. Psychological Bulletin, 130(2), 261–288.

-Smith, Margaret R. Student Aid. (1936). The Journal of Higher Education, 7(1), 29-35. Retrieved March 16, 2014, from http://www.jstor.org/stable/1974303

-USDE (U.S. Department of Education). (2014). How Aid is Calculated. Retrieved March 21, 2014, from http://studentaid.ed.gov/fafsa/next-steps/how-calculated

The college rating system vs institutional integrity and cost

The college rating system, originally intended to enhance the quality of university education, has motivated an institutional focus on prestige over affordability. It is through this competitive focus that lower-income students have been disenfranchised as college education becomes increasingly expensive. To combat the negative impacts of the rating system on the cost of university education in the U.S., President Obama proposed reforms to the college rating system. However, these proposals—if enacted—could restrict rather than enhance opportunity for disadvantaged students.

The college rating system, originally intended to enhance the quality of university education, has motivated an institutional focus on prestige over affordability. It is through this competitive focus that lower-income students have been disenfranchised as college education becomes increasingly expensive. To combat the negative impacts of the rating system on the cost of university education in the U.S., President Obama proposed reforms to the college rating system. However, these proposals—if enacted—could restrict rather than enhance opportunity for disadvantaged students.

The university ranking system was originally intended as a system to enhance universities through the enforcement of a spirit of competition, improvement in the quality of a university education, and a sense of transparency for consumers in the college market. Among the institutes furnishing college ratings, is the U.S. News & World Report, which began its university ranking in 1983. Although standards of rating have changed since the founding the U.S. News & World Report, this report continues to assess US institutions based on resources available to undergraduate students and faculty, overall quality of education, graduation rates, and post graduate opportunity.1

Notwithstanding that the university ranking system is seen as enhancing the quality of university education, it has become subject of scrutiny. As more and more studies reveal the true cost and quality of institutional data circulated by the U.S. News & World report, it becomes clear that not all ramifications of this establishment are positive to university quality. Strong critics of the U.S. News ratings claim that it detracts from learning by focusing solely on the quantitative end product of education—a grade.

U.S. News doesn’t measure the most important thing on campus–actual learning–it is pushing colleges to prioritize in ways that are not necessarily the best. In a sense, the rankings are like a professor who ignores the content of her student’s papers and instead bases her grades only on spelling and punctuation.2

It is thus evident that, in its rankings, the US News & World report neglects certain variables in favor of others. In this manner, the report involves a degree of error from the get-go. This inherent flaw in college ratings has given rise to two fundamental issues in the college market: skewed institutional policies and the disenfranchisement of lower-income students.

First and foremost, by incorporating a spirit of competition in the college market, the college ranking system skews institutional policies. This perversion of institutional policies might cause college or university personnel to work against their own missions in what has amounted to a costly “arms race”. In a race for institutional prestige it has become increasingly popular for institutions to “link tuition discounts with academic merit and student ability” and “invest in student consumption benefits such as dormitories, eating facilities, or fiber optic computer networks”.3 An increased focus on institutional prestige within the college system, in effect, disenfranchises lower-income students. To explore this issue in depth, one ought consider that the ratings system incentivizes institutions to spend more on educational “inputs”. 4

The impact of such financial expenditures is an increase in the overall cost of college and higher standards for admission. As colleges continually opt for pricey campus sustainability projects, renovated facilities, and the latest technologies, prices typically rise to finance expenditures. In this manner, “a majority of the nation’s highest ranking colleges and universities actually enroll a smaller percentage of low-income students than was the case 20 years ago.”5

In light of these unabating issues attributed to the college rating system, President Obama formulated a proposal for an altered college rating system in the U.S. in August 2013. Through this proposal—yet to be passed by Congress, Obama intends to reform the system by tying individual students’ financial aid to government ratings of the college they attend. In allocating government funds to institutions of high academic quality, the President hopes to enhance the university system within the U.S.6

However, through this proposed system, the Obama administration could inadvertently restrict, rather than enhance, opportunity for disadvantaged students. The new ratings system proposed by the administration could lessen opportunity for lower-income students in basing grant money on outcomes such graduation rates and job placement, rather than on the nature of the students themselves. Thus, this proposal can be seen as inherently flawed in its lack of consideration for the correlation of lower completion rates with “poverty, poor preparation, commuter and part-time attendance, and non-traditional adult age status.”7

In the future of the college ratings system, demand for transparency and information will continually increase as higher education becomes more costly for individuals and families.8 Thus, ultimately, the approach taken by college ranking establishments—such as U.S. News & World Report—and the Obama administration will determine future costs of college education. In differentiating between prestige and affordability, these systems could reverse some of the financial damage done and make college more affordable for lower income scholars. However, in terms of current trends in the university rating system, the distinction between a university lacking in quality education from a university lacking in means is yet to be made. Until such distinctions are realized, the current trend will persist with lower income students being put at a further financial disadvantage.

References:

1. Institute for Higher Education Policy. (2007). College and University Ranking Systems: Global Perspectives and American Challenges. Retrieved February 24, 2014 from http://www.ihep.org/assets/files/publications/a-f/CollegeRankingSystems.pdf

2. Thompson, Nicholas. (Sept., 2000). Playing With Numbers: How U.S. News mismeasures higher education and what we can do about it. Retrieved February 25, 2014 from Washington Monthly.com Website:http://www.washingtonmonthly.com/features/2000/0009.thompson.html

3./4. Dill, David D. & Maarja Soo. (Jun., 2005). Academic Quality, League Tables, and Public Policy: A Cross-National Analysis of University Ranking Systems. Higher Education, 49(4), 495-533

5. The Journal of Blacks in Higher Education. (Fall, 2006). High-Ranking Colleges and Universities Show Little Progress in Increasing Their Enrollments of Low-Income Students. The Journal of Blacks inHigher Education, 53, 50-59. Retrieved March 3, 2014 from http://www.jstor.org/stable/25073537

6. Riskind, Jonathan. (Dec., 2013). Rating Obama’s Ratings Plan. Retrieved March 4, 2014 from American Council on Education.edu http://www.acenet.edu/the-presidency/columns-and-features/Pages/Rating-Obama%27s-Ratings-Plan.aspx

7. Lederman, Doug, Stratford, Michael & Jaschik, Scott. (February 7, 2014). Rating (and Berating) the Ratings. Retrieved February 21, 2014 from Inside Higher Ed.com Website: http://www.insidehighered.com/news/2014/02/07/colleges-and-analysts-respond-obama-ratings-proposal#ixzz2vDWISN9P

8. Dill, David D. & Maarja Soo. (Jan., 2004). Transparency and Quality in Higher Education Markets. Retrieved February 23, 2014 from http://www.unc.edu/ppaq. Website: http://www.unc.edu/ppaq/docs/Douro2.pdf

A Congressional Comedy of Student Loan Errors

In the modern day of media communication, headlines swarm the public eye with pessimistic accounts of the “rising costs of college” and “staggering student loan debt” (Wagstaff, 2013). When one considers the financial reality faced by college students, these headlines and quantitative data are not far from the truth. Now, more than ever before in the history of the US, the financing of a university education has become a costly dilemma for college students: a dilemma rooted in a Congressional comedy of student loan errors.

The current issue with federal student loans began in 1992, when Congress permitted government-backed student loans without parent income restrictions (Kantrowitz1, 2014). Once the government made it exceptionally easy for students to borrow massive amounts of money, colleges followed the lead by increasing their tuition rates. It is thus that the sudden injection of millions of additional aid dollars only furthered tuition costs, which have seen a 498.31% rise since 1985 (McMahon, 2013). In conjunction with the government’s continued promotion of the Stafford Loan as a low-cost program, a hyperinflationary cycle of education costs was set in motion (Kantrowitz2, 2014).

The state of the hyper-inflated student loan market further deteriorated in 2013 with the passage the Bipartisan Student Loan Certainty Act of 2013. On July 2013, Congress passed this loan act, known as H.R. 1911, after student loan rates had been allowed to skyrocket from previously fixed rates. H.R. 1911 greatly impacted the student loan rates of the Stafford and PLUS loans—issued to undergraduate students by the federal government—by tying these loan rates to market values and by providing an 8.25% cap on interest rates (Weinberg, 2013).

Apart from altering the interest rates on student loans, H.R. 1911, was also seen as producing a positive economic outcomes in the federal budget. To put these Congressional stipulations into comprehensible numbers, one might consider the words of the US Congressional Budget Office (CBO). The CBO, charged with the task of estimating the costs of the Act, asserts that “H.R. 1911 would reduce direct spending by about $1.0 billion over the 2013-2018 period and by $3.7 billion over the 2013-2023 period” (CBO, 2013). In this way, H.R. 1911 boasts a favorable economic outcome in terms of government spending.

However, it is only by glancing between the lines of legislative jargon that an ominous reality becomes clear: this “reduction in direct spending” will come from the pockets of university students, and is drawn from the idea of student loans as source of profit, rather than an investment designed to create opportunity (CBO, 2013). In this way, the student loan issue becomes a modern age paradox where the scales could be seen as tilted against university students.

As it would seem, Congressional action within the past decades has not been favorable to the economic situation of the average middle class college student and serves as a factor attributing for the ridiculously high costs of college and ever-increasing levels of student debt. Although this modern age dilemma is not set in stone, it will take much effort to level the playing field for financially volatile university students so as to make college more affordable (Ottaunick, 2014).

There are signs that the federal government is trying to reverse these negative trends, as with the College Affordability and Innovation Act of 2014 (GovTrack.US, 2014). However, time will only tell whether or not this act, which aspires to decrease college costs and to improve the quality of education, will be enough to compensate for the flawed financial formula of disaster concocted by Congress which now resonates in the public sphere in the form of further student debt and economic uncertainty.

References:

1. Congressional Budget Office (CBO). (May 20, 2013). Congressional Budget Office Cost Estimate:H.R. 1911. Smarter Solution for Students Act. Retrieved February 8, 2014 from http://www.cbo.gov/sites/default/files/cbofiles/attachments/HR%201911_0.pdf

2. Kantrowitz, Mark1. (2014). History of Student Financial Aid.Retrieved February 8, 2014 from FinAid: the smart student guide to financial aid http://www.finaid.org/educators/history.phtml

3.Kantrowitz, Mark2. (2014). Student Loans. Retrieved February 8, 2014 from FinAid: the smart student guide to financial aid Website: http://www.finaid.org/loans/

3. McMahon, Time. (April, 3, 2013). Inflation Data: Education Inflation. Retrieved February 7, 2014

from InflationData.com Website: http://chronicle.com/article/Senate-Approves-Deal-on/140533/

4. Ottaunick, Taryn. (February 4, 2014). Cost of student loan programs difficult for federal government to determine, study suggests. Retrieved February 8, 2014 from The Daily Free Press: The Independent Student Newspaper at Boston University. Website: http://dailyfreepress.com/2014/02/04/cost-of-student-loan-programs-difficult-for-federalgovernment-to-determine-study-suggests/

5. Wagstaff, Keith. (July, 1, 2013). 3 terrible realities facing today’s college student. Retrieved February 3,2014 from The Week.com Website: http://theweek.com/article/index/246370/3-terrible-realities-facing-todays-college-students

6. Weinberg, Cory. (July 24, 2013). Senate Approves Deal onStudent-Loan Interest Rates, Ending Standoff. Retrieved February 5, 2014 from The Chronicle of Higher Education Website: http://chronicle.com/article/Senate-Approves-Deal-on/140533/

7. GovTrack.US. (2014). S. 1969: College Affordability and Innovation Act of 2014. Retrieved February 6, 2014 from https://www.govtrack.us/congress/bills/113/s1969

Living Through Your First Semester: Cheap ways to live and be active

The frugal lifestyle of college students is legendary — and it is all too true. If you haven’t yet felt the effects of a tuition bill, you might not understand just yet, but you certainly will in the near future. While sitting around with friends, it may seem impossible to do anything without spending money on food, or gas, or….other substances, but there are several options to maintaining a balanced budget.

From food to fun, here are some great ways to not spend a dime and still live happily:

-

Clubs. Look at the university club list and find something that you’re interested in. Almost every club plans events, trips and socials, and if you convince some friends to join, it can be some great fun for cheap, or even free!

-

Campus Events. The campus occasionally holds musical and performing arts shows at Nordica or Emery. There are many other events on a regular basis put on by the variety of clubs on campus; keep your eyes out for their advertisements. Check out things like Dollar Movie Night and Popcorn Cinema, two great ways to see a movie and hang out with friends without stretching your budget.

-

Games. Whether it be kicking a soccer ball around or playing Cards Against Humanity, setting aside time for games can be a great way to have endless amounts of fun with friends. Some board games and sport equipment can be expensive, but it’s a one-time investment, and in the end you’ll only have paid a few cents per use.

-

Walks and hikes. We are fortunate enough to be in an area with many trails and woodlands. You can walk to Bonney or Flint woods for a casual stroll, head down to the Sandy River for a walk and swim, or drive to hiking trails such as Tumbledown or Bald Mountain. This is a free activity that is good for your mental and physical health.

-

Food. For your food budget, the answer may be obvious — if you’re living on campus, use your meal plan (preferably a small one) and make the rest of your food in the dorm kitchen. If you’re a coffee drinker, invest in a coffee maker; don’t go to Dunkin for your morning coffee. You will be surprised how much those small expenditures add up. Imagine yourself going to get a cup of coffee three times a week for $3 per cup, that’s a total of $36 a month.

-

Jobs. Whether you work 12 hours or 2 hours per week, every little bit helps. Having an income will prevent you from exhausting your savings. There are many opportunities ranging from work study and work initiative positions at school to working for local coffee shops and restaurants. University jobs will more often provide flexible schedules for students; however, they most often offer fewer weekly hours. It’s definitely worth it to drop off your resume at a few places.

-

Take advantage of trip home. It’s always nice to see your family once in awhile. Plus all the extra free meals and laundry that you get.

Student Loan Debt Clock

With numbers soaring above $1 Trillion it’s not a bad idea to keep an eye on our student loan debt.

Free Food?! UMF MEAL PLAN SCHOLARSHIP!!

MAURER MEALS / UMF DINING SERVICES

MEAL PLAN SCHOLARSHIP ESSAY GUIDELINES

In 2005, Justin Maurer, a 2004 high honors graduate of the UMF Community Health

Program, died in a motorcycle accident. His parents and friends established a scholarship

in his memory for a third or fourth year Community Health major. The Maurer Meals

Project was formed: “To raise money for the Justin A. Maurer Memorial Scholarship at

UMF while raising awareness of activities necessary to improve local community health

nutritionally, economically, environmentally and spiritually.” The main focus of the

project has been Maurer Meals, occurring annually the weekend following Columbus

Day weekend. More about Justin, Maurer Meals, the Memorial Scholarship and the

Project goals can be found at Maurer Meals.com.

UMF Dining Services has been involved in both buying local and sustainable activities

for a long time. UMF Dining Services has very generously offered The Maurer Meals

Project two fifty meal plan scholarships each year to be used in a way that will 1) benefit

deserving UMF commuter students and, 2) further the goals of improving community

health through increasing awareness of the benefits of using locally produced and

sustainably produced foods.

The Project Steering Committee has decided to award these food plan scholarships in the

following manner:

1) A UMF commuter student will submit a 500 – 1,000 word essay addressing the

following:

A) Locally produced and sustainably produced foods – why it matters

B) What I have done to improve my community’s health and well being

(for purposes of this essay “community” will have a very broad meaning –

any group or groups of people with common interests).

2) Separately, but concurrently, the student will submit a paragraph or two on the

topic: “Why the meal plan scholarship will be financially meaningful to me”.

Both essays will be submitted via email to Denise Boothby by March 29, 2013

at denise.boothby@maine.edu subject heading: meals plan scholarship essays

submission.

Zero, one, or two 50 meal plan scholarships will be awarded in April, 2013 for

use ONLY during the 2013-2014 school year.